Corporate Governance, Risk Management and Compliance

Thaire Life Assurance engages in all types of life reinsurance business, integrating corporate governance, risk management, and compliance (GRC) in management to integrate personnel, processes, information, and technology systematically to efficiently and lead the organization to the purpose of sustainable development.

Corporate Governance

The Company recognizes the importance of good corporate governance and aims to conduct its business in accordance with established policies. This governance framework emphasizes shareholders' rights, the equal treatment of shareholders, and the need for transparency and information disclosure. It also supports the Board's responsibilities to create business advantages, preserve the company's capital, and enhance long-term shareholder value, all within an ethical framework. The Company is committed to resisting corruption, respecting human rights, and considering the interests of all stakeholders and society, which are essential for promoting the organization’s sustainability.To maximize the benefits of good governance and comply with the principles set forth by the SEC and other best practices, the Board of Directors has established the Nomination and Remuneration Committee. This committee is tasked with selecting qualified directors to be proposed to the Board or at shareholders' meetings. The selection process considers various factors such as knowledge, skills, expertise, and relevant work experience that meet the requirements of the vacant positions. To evaluate the qualifications of all directors, the committee uses a Board Skill Matrix, which is regularly reviewed to ensure its continued relevance and appropriateness.

Risk Management

Risk Management Governance Structure

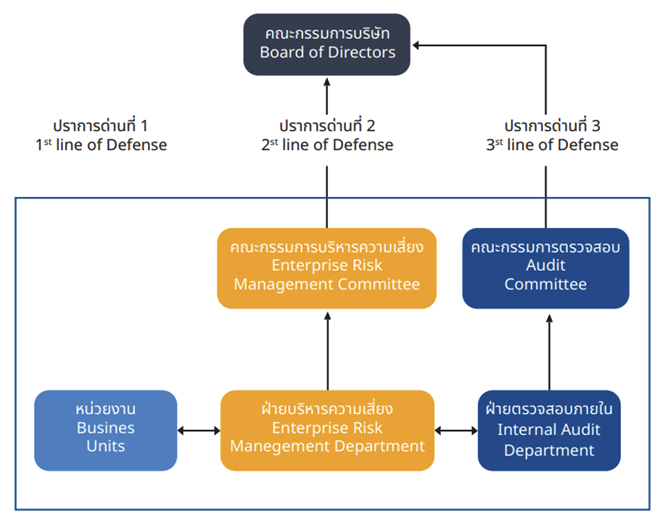

The company's risk management governance structure follows the Three Lines of Defense model: The First Line of Defense: Oversees the daily business risk management within each department, under the supervision of the Risk Management Subcommittee, which consists of executives from various departments. Second Line of Defense: Ensures the adequacy, efficiency, and effectiveness of risk management, overseen by the Risk Management Committee, with the Risk Management Department providing support. Third Line of Defense: Assures the effectiveness of risk management through audit mechanisms, including the Audit Committee and the Internal Audit.

Risk Management Process

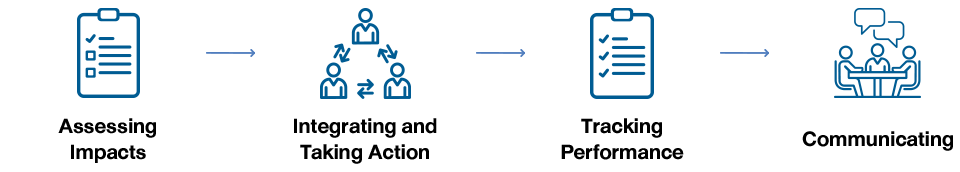

The company has established its Risk Appetite to guide the formulation of strategies, operational policies, and enterprise-wide risk management. The primary focus is on identifying key risks that could affect its capital funds, financial stability, and corporate reputation. To achieve this, the company conducts comprehensive risk assessments and analyzes the interrelationships between various risks. It defines appropriate risk indicators and thresholds, implements risk control measures to keep key risks within acceptable levels, and continuously evaluates the effectiveness of these measures.

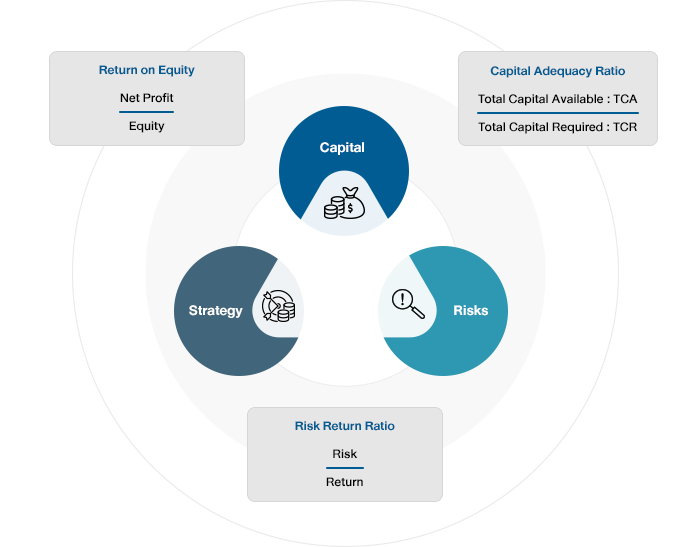

The company utilizes risk management as a key tool in organizational management to ensure that its strategic direction, planning, daily operations, and decision-making processes are conducted with careful consideration of all relevant risks and the capital required to mitigate them. Additionally, the company sets interconnected objectives that align strategy, risk management, and capital adequacy to maintain a balanced and sustainable approach to business operations.

TH

TH

Be certified member of Thai Private Sector Collective Action

Be certified member of Thai Private Sector Collective Action