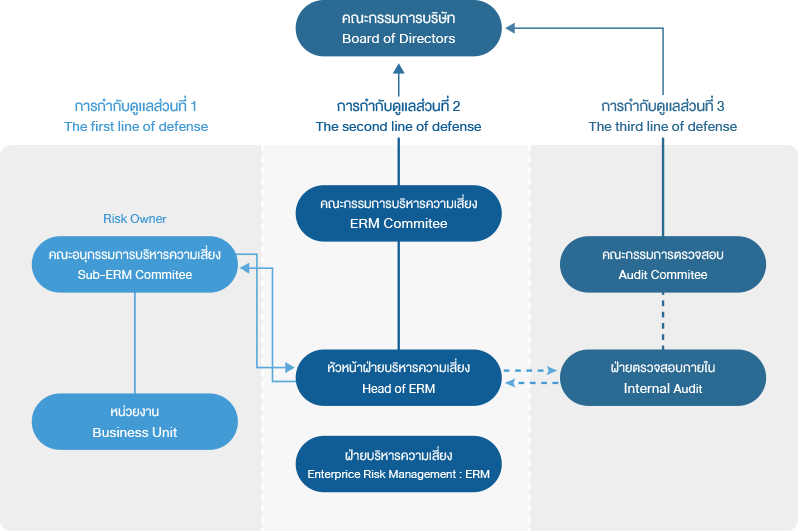

The company (THREL) risk governance structure is based on “Three lines of defense” model. The first line of defense is functions that own and manage risk in daily business operations under supervision of Sub-ERM committee. The second line of defense is risk management department that oversee efficiency and effectiveness of ERM under supervision of ERM committee. The third line of defense is internal audit department that provide assurance of ERM under supervision of Audit committee.

Enterprise Risk Management : ERM

Enterprise Risk

Management Structure

THREL faces both internal and external challenges that affect the way the business is operated. To meet these challenges the Company has developed a risk management framework to help accomplish its vision, mission, short and long-term goals as well as maintain its financial stability, reputation, image, competitive advantage and sustainability. This framework is developed from the Insurance Core Principles (ICP) of the International Association of Insurance Supervisors (IAIS) and corresponds to the OIC’s risk management requirements.

The Company determines its Risk Appetite and applies this in the formulation of strategy and operational policy as well as the establishment of enterprise risk management guidelines. In the process of risk management, key risks that may affect the capital fund, financial stability and reputation of the Company are identified, assessed and analyzed. The Company establishes risk indicators using appropriate threshold to measure and manage these risks to an acceptable level whilst also monitoring the effectiveness of these measures. Focusing on learning from actual loss, THREL then revises both measures and risk indicators to cope with changing environment, regularly monitors key risks and reports the results of risk management activities to both the Enterprise Risk Management Committee and the Board of Directors every quarter.

The Company determines its Risk Appetite and applies this in the formulation of strategy and operational policy as well as the establishment of enterprise risk management guidelines. In the process of risk management, key risks that may affect the capital fund, financial stability and reputation of the Company are identified, assessed and analyzed. The Company establishes risk indicators using appropriate threshold to measure and manage these risks to an acceptable level whilst also monitoring the effectiveness of these measures. Focusing on learning from actual loss, THREL then revises both measures and risk indicators to cope with changing environment, regularly monitors key risks and reports the results of risk management activities to both the Enterprise Risk Management Committee and the Board of Directors every quarter.

TH

TH

Be certified member of Thai Private Sector Collective Action

Be certified member of Thai Private Sector Collective Action